It Is Time To Discuss A Critical And Yet Underestimated Part Of Price Management – The Quotation.

By Julia Georgi

With Vulcan Materials Co., Martin Marietta Materials, Summit Materials and Heidelberg Materials reporting record price increases in the first quarter of 2023, price and revenue management is finally becoming mainstream in our industry.

Those remarkable success stories of publicly traded industry leaders, as detailed in their quarterly reports, speak for themselves:

Vulcan Materials Co.

Aggregate shipments were down 2% in the first quarter at Vulcan Materials Co., but the nation’s top producer noted that the pricing environment remains positive. Pricing actions effective at the start of the year resulted in another quarter of accelerating price growth. Tom Hill, Vulcan Materials’ chairman and chief executive officer, said, “Aggregates earnings increased sharply with cash gross profit per ton improving 23% and gross margin expanding despite lower shipments and persistent inflationary cost pressures.” Freight-adjusted selling prices increased 20%, or $3.15 per ton, as compared to the prior year, with all markets realizing year-over-year improvement. Adjusting for mix impacts, average selling prices increased 19% in the first quarter.

Martin Marietta Materials

Martin Marietta Materials set a first-quarter record in gross profit, reporting total revenues of $1.354.1 billion, versus $1.230.8 in the first quarter of 2022, a 10.0% increase. The Building Materials business generated record first-quarter revenues of $1.27 billion, a 10.1% increase. Gross profit increased 99.4% to a first-quarter record of $275.9 million. Double-digit pricing gains, partially offset by continued inflationary pressure, resulted in gross margin improvement of 970 basis points. Ward Nye, chairman and CEO of Martin Marietta, stated, “Our year is off to a remarkable start with record first-quarter results by nearly every measure including continued world-class safety incidence rates. The cumulative effects of our 2022 and Jan. 1, 2023, pricing actions drove robust margin expansion despite continued inflationary pressure and modestly lower aggregates shipments.”

Summit Materials

Average selling prices for aggregates increased 20.5%, the strongest quarterly growth rate in the company’s history. Growth was witnessed across all markets and led by the strongest gains in Texas and the Intermountain West. Summit President and CEO Anne Noonan said, “It’s clear by our record first-quarter results that we have a solid head start as we enter the prime construction season.”

Heidelberg Materials

Heidelberg Materials reported that in the first quarter, sales volumes declined as a result of the economic downturn linked to lower construction activity, especially in residential construction, due to inflation and increased financing costs; however, revenue rose significantly by 10.6% in comparison with the previous year.

Those testimonials once again reconfirm that a well-executed and timely price increase by all means surpasses volume increases, but at the same time they give industry players no practical guidance on how to get there.

It is time to discuss a critical and yet underestimated part of price management – the quotation.

The Paradox of Quotation

From a sales process perspective, quotation plays a key role and can be seen from various perspectives.

- First, it is obviously one of the key touch points with the customer that often leaves a written proof of price levels, validity periods and other sales conditions.

- Second, it is an integral and a highly time-consuming part of sales people’s job. According to the Price Bee 2021 study, “Salespeople spend up to 60% of their time on quotation and order fulfillment activities.”

- And last, it is a representation of the company’s order-fulfillment process because sales can only quote what can be processed by a point-of-sales, dispatch and an ERP systems.

The paradox of quotation is that while being extremely limited by highly structured internal systems and processes it is the only chance to get pricing to a broader audience via bids and projects.

That is probably one of the reasons why some smaller players choose to stay offline and simply quote using paper or emailing word/excel documents. They feel in control and get so used to creativity and ad-hoc adjustments that transitioning to any modern tools will be impossible without a proper business turn around.

Not to mention that it is an analytical and data input nightmare. Sadly those players would never know how much upside they are missing.

Other industry players try to build in-house quotation solutions, but are often missing the point. Because even with the best intentions they will end up prioritizing the IT roadmap that more often than not will tend to keep the point-of-sales systems undisrupted.

As a result, their quotation solution will be perfectly aligned with the order fulfillment process but may miss some key elements like transportation cost calculation, quote life cycle management or, even worse, it may completely dismiss some critical customer contact information that is not needed for order taking or billing.

The above-mentioned examples are two extremes. The first one is highly flexible with no future at all; the second one will survive much longer, but eventually will not appeal to a younger generation of sales people.

And of course there are lucky companies out there that get quotation right either thanks to competent sales management that drives robust processes using various software and offline models or thanks to a sole end-to-end quotation software that is built upon such processes.

The Role Quotation Plays in Pricing

From a broader pricing strategy perspective quotation could appear less critical because not all sales are quoted; and some building material producers, aggregates in particular, actually do not quote at all or quote next to nothing. Despite that when a company reaches higher sales and pricing maturity levels, pricing becomes consistent across all systems and various strategic targets are easy to implement and monitor on any level.

For example, if customer target prices are defined using margin objectives the good quotation software would allow for a real time analysis of all quotes with a clear view of how each salesperson, customer, plant or product are doing with regards to the desired target price. At the same time any quoted target price breach can be easily monitored. Picture 1 illustrates one version of such analysis.

Although we are all aware that the interpretation of quoted prices is highly contextual in our industry, it is still a great way to gather real time market feedback regarding a company’s pricing strategy. Many industry people rely on won and lost reports to get market feedback, but this is more of a lagging indicator that tells us every little about the relevance of the price strategy.

On the contrary, understanding sales teams’ pricing behaviors will not only provide real time feedback regarding the company’s pricing strategy, but will also give an indication of their confidence in a market. That in general is a sign of another pricing opportunity.

Another example of how quotes can help improve pricing strategy is by capturing information about discounts given to customers. One of the challenges of building materials pricing is to determine correct and acceptable discounts levels. Due to a low number of seasonal transactions and a vast majority of products plants sell in each market, usual pricing elasticity models provide very little tactical value.

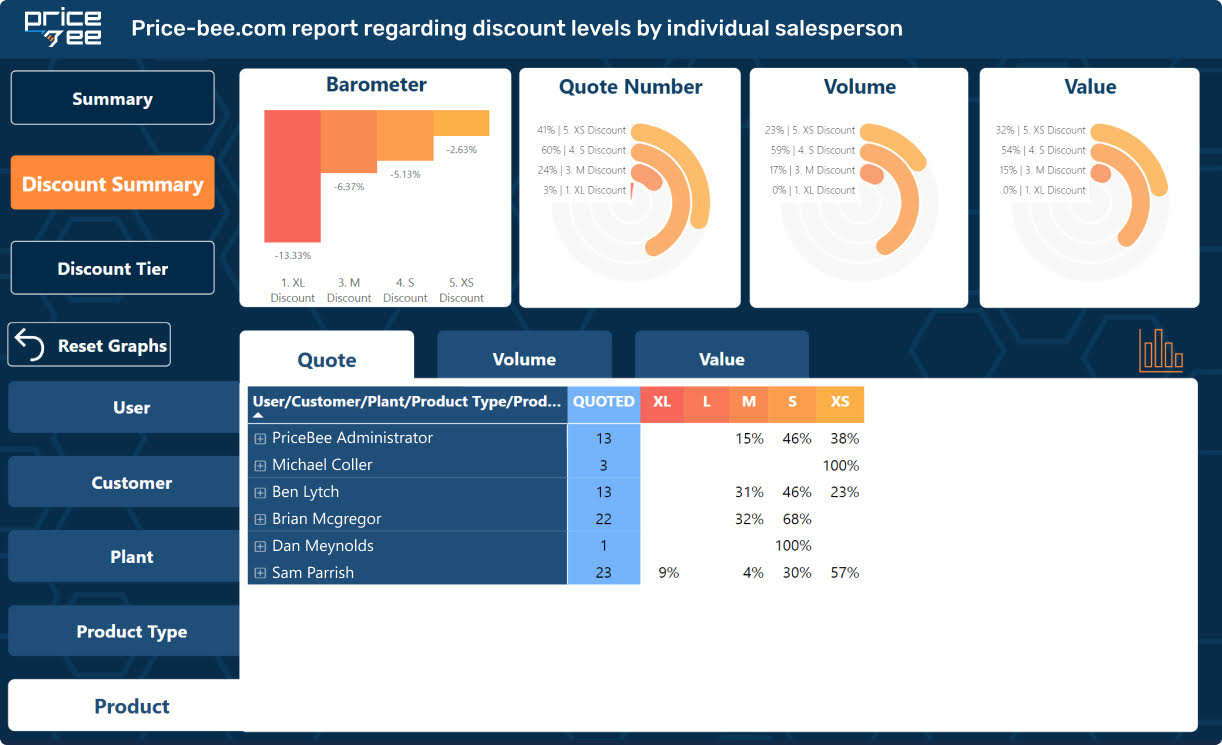

In this scenario analyzing discount ranges of quoted products is a great way to identify fare discount levels for certain customer groups while getting a clear picture whether a desired discount policy is working or not. Picture 2 illustrates one version of such analysis.

It is clear that to execute these record price increases, a company needs more than just a vision or a well prepared Power Point presentation. The right software is needed to help managers to formulate the desired pricing strategy and sales teams to execute it accordingly. Some industry specific Configure, Price, Quote solutions (CPQ) are built exactly for that purpose.

Price-Bee.com is one of these CPQ products that is changing construction materials profitability globally while digitizing the sales process and improving customer experience.

Julia Georgi is the COO and co-founder of Price-Bee.com.